Fair value accounting and the subprime mortgage crisis

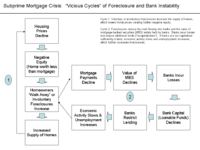

Fair value accounting is a way of tracking the value of something. For example, if you bought a house for $100,000, the fair value would be that same amount. The problem with fair value accounting and the subprime mortgage crisis is that when the prices of houses and other investments started dropping, the fair value of those investments also dropped, even if the people who had bought them had not yet sold them. This caused some banks and other businesses to lose a lot of money.