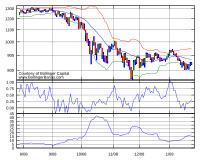

Bollinger Bands

Bollinger Bands are like a special kind of rubber band that is used to see how the price of something is moving up and down.

Imagine you have a toy car that you are racing. You put a rubber band around the car to see how far it can go before it stops. Bollinger Bands are like that rubber band around the price of something you are trading or investing in (like stocks).

The rubber band is not just one band, but actually three bands that are all stuck together. The middle band is like the average price of the thing you are trading. The top band is like the highest price the thing has been recently. And the bottom band is like the lowest price the thing has been recently.

When the price of the thing you are trading moves quickly, the bands get wider apart like someone stretching the rubber band. When the price moves slowly, the bands get closer together like someone relaxing the rubber band.

Traders and investors use the Bollinger Bands to see if the price is getting too high or too low compared to what it has been in the past. It's like saying, "Hey, the price is getting too high and might drop soon" or "Hey, the price is getting too low and might go up soon."

So, that's Bollinger Bands – a special set of rubber bands that tells you how the price of something is moving up and down, and whether it is getting too high or too low.

Imagine you have a toy car that you are racing. You put a rubber band around the car to see how far it can go before it stops. Bollinger Bands are like that rubber band around the price of something you are trading or investing in (like stocks).

The rubber band is not just one band, but actually three bands that are all stuck together. The middle band is like the average price of the thing you are trading. The top band is like the highest price the thing has been recently. And the bottom band is like the lowest price the thing has been recently.

When the price of the thing you are trading moves quickly, the bands get wider apart like someone stretching the rubber band. When the price moves slowly, the bands get closer together like someone relaxing the rubber band.

Traders and investors use the Bollinger Bands to see if the price is getting too high or too low compared to what it has been in the past. It's like saying, "Hey, the price is getting too high and might drop soon" or "Hey, the price is getting too low and might go up soon."

So, that's Bollinger Bands – a special set of rubber bands that tells you how the price of something is moving up and down, and whether it is getting too high or too low.