Butterfly (options)

Hey there kiddo! Have you ever heard of a butterfly? It's not just a pretty insect, it's also a type of strategy that's used in the stock market. Let me explain it to you like you're five years old.

Imagine you have a pack of cards with four aces, and you want to make some money by betting on which cards will come up. You could bet on just one ace, but that's risky - what if another ace comes up instead? So instead, you could use the butterfly strategy.

First, you bet on two aces - let's say the ace of diamonds and the ace of spades. If one of those cards comes up, you'll make some money. But to make sure you don't lose too much if the other two aces come up, you also bet against them. So you bet that the ace of clubs and the ace of hearts won't come up.

This might seem like a lot of bets, but they all balance each other out. If the two aces you bet on come up, you'll win twice as much as you bet. If one of the other aces comes up, you'll lose one bet but win one, so you'll break even. And if all four aces come up, you'll only lose one bet. It's like holding a butterfly in your hand - it can only escape if it flies perfectly straight, but if it wobbles even a little, it'll stay in your hand.

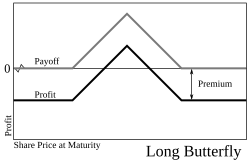

In the stock market, the butterfly strategy works similarly. Instead of betting on aces, you're betting on options - contracts that let you buy or sell stocks at a certain price. You buy two options with a middle price (the "body" of the butterfly) and sell two options with a higher price and two with a lower price (the "wings" of the butterfly). This way, if the stock price stays in a certain range, you'll make money, but if it moves too far in either direction, you'll lose some of your bets but gain on others.

So that's the butterfly! It's all about balancing your bets and using multiple strategies to make sure you come out on top. Kind of like catching a butterfly - you have to be patient, quick, and always have a plan.

Imagine you have a pack of cards with four aces, and you want to make some money by betting on which cards will come up. You could bet on just one ace, but that's risky - what if another ace comes up instead? So instead, you could use the butterfly strategy.

First, you bet on two aces - let's say the ace of diamonds and the ace of spades. If one of those cards comes up, you'll make some money. But to make sure you don't lose too much if the other two aces come up, you also bet against them. So you bet that the ace of clubs and the ace of hearts won't come up.

This might seem like a lot of bets, but they all balance each other out. If the two aces you bet on come up, you'll win twice as much as you bet. If one of the other aces comes up, you'll lose one bet but win one, so you'll break even. And if all four aces come up, you'll only lose one bet. It's like holding a butterfly in your hand - it can only escape if it flies perfectly straight, but if it wobbles even a little, it'll stay in your hand.

In the stock market, the butterfly strategy works similarly. Instead of betting on aces, you're betting on options - contracts that let you buy or sell stocks at a certain price. You buy two options with a middle price (the "body" of the butterfly) and sell two options with a higher price and two with a lower price (the "wings" of the butterfly). This way, if the stock price stays in a certain range, you'll make money, but if it moves too far in either direction, you'll lose some of your bets but gain on others.

So that's the butterfly! It's all about balancing your bets and using multiple strategies to make sure you come out on top. Kind of like catching a butterfly - you have to be patient, quick, and always have a plan.