Condor (options)

Imagine you really like playing with toys, and you have a lot of different toys to choose from. You have teddy bears, action figures, Barbies, and so on. Now, let's pretend that you and your friend are playing together, and you both want to play with certain toys. You both want the same teddy bear and the same Barbie, but there's only one of each. So how do you solve this problem?

Well, you could make a deal with your friend. You could say, "Okay, I'll let you have the teddy bear if you let me have the Barbie." This way, both of you get something you want, and neither of you has to fight over toys or get upset.

Now, let's translate this into the stock market. Instead of toys, we have something called options. An option is a contract that gives you the right to buy or sell a certain stock at a certain price, on or before a certain date. For example, let's say you have an option to buy 100 shares of Apple stock for $150 per share, and the option expires on June 1st.

Now, let's say you're not sure if you want to buy those shares yet. Maybe you're waiting to see if Apple's stock price goes up or down. So you decide to buy what's called a "put option" as a way to protect yourself. A put option lets you sell a certain stock at a certain price, on or before a certain date. In this case, you buy a put option that lets you sell 100 shares of Apple stock for $140 per share, if you want, on or before June 1st.

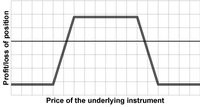

But wait, there's more! Let's say you want to get even fancier with your options. You could do something called a "condor spread." A condor spread is a combination of four different options: two put options and two call options (which give you the right to buy a certain stock at a certain price).

Here's how it works: You buy one put option that lets you sell 100 shares of Apple stock for $140 per share, and you sell another put option that lets you sell 100 shares of Apple stock for $135 per share. This means that if Apple's stock price drops below $140, you can sell your shares for $140 each, making a profit. But if the price drops even further, down to $135 or below, you're in trouble, because now you have to buy shares at $135 and sell them at $140, which means you lose money.

But don't worry, here's where the call options come in. You buy one call option that lets you buy 100 shares of Apple stock for $160 per share, and you sell another call option that lets you buy 100 shares of Apple stock for $165 per share. This means that if Apple's stock price goes up above $160, you can buy shares for $160 each and then sell them for $165 each, making a profit. But if the price goes up even higher, to $170 or above, you're in trouble, because now you have to buy shares at $165 and sell them at $160, which means you lose money.

So, why would you want to do a condor spread? Well, it's a way to both protect yourself from losses and potentially make a profit, depending on how the stock price moves. It's like playing with toys and making a deal with your friend: You both get something you want, and nobody gets upset.

Well, you could make a deal with your friend. You could say, "Okay, I'll let you have the teddy bear if you let me have the Barbie." This way, both of you get something you want, and neither of you has to fight over toys or get upset.

Now, let's translate this into the stock market. Instead of toys, we have something called options. An option is a contract that gives you the right to buy or sell a certain stock at a certain price, on or before a certain date. For example, let's say you have an option to buy 100 shares of Apple stock for $150 per share, and the option expires on June 1st.

Now, let's say you're not sure if you want to buy those shares yet. Maybe you're waiting to see if Apple's stock price goes up or down. So you decide to buy what's called a "put option" as a way to protect yourself. A put option lets you sell a certain stock at a certain price, on or before a certain date. In this case, you buy a put option that lets you sell 100 shares of Apple stock for $140 per share, if you want, on or before June 1st.

But wait, there's more! Let's say you want to get even fancier with your options. You could do something called a "condor spread." A condor spread is a combination of four different options: two put options and two call options (which give you the right to buy a certain stock at a certain price).

Here's how it works: You buy one put option that lets you sell 100 shares of Apple stock for $140 per share, and you sell another put option that lets you sell 100 shares of Apple stock for $135 per share. This means that if Apple's stock price drops below $140, you can sell your shares for $140 each, making a profit. But if the price drops even further, down to $135 or below, you're in trouble, because now you have to buy shares at $135 and sell them at $140, which means you lose money.

But don't worry, here's where the call options come in. You buy one call option that lets you buy 100 shares of Apple stock for $160 per share, and you sell another call option that lets you buy 100 shares of Apple stock for $165 per share. This means that if Apple's stock price goes up above $160, you can buy shares for $160 each and then sell them for $165 each, making a profit. But if the price goes up even higher, to $170 or above, you're in trouble, because now you have to buy shares at $165 and sell them at $160, which means you lose money.

So, why would you want to do a condor spread? Well, it's a way to both protect yourself from losses and potentially make a profit, depending on how the stock price moves. It's like playing with toys and making a deal with your friend: You both get something you want, and nobody gets upset.

Related topics others have asked about: