Ladder (option combination)

Imagine you're playing with alphabet blocks. You have some blocks with the letters A, B, C, D, and E. You can stack them any way you want to make different words.

Now, let's say you want to make a ladder with the blocks. You start with the letter A on the bottom and stack the other blocks on top in alphabetical order. So it goes A, B, C, D, E.

In finance, a ladder is a similar concept but instead of blocks, we're using options (which are like contracts to buy or sell stocks). An options ladder involves buying a combination of options with different expiration dates.

For example, you might buy one option contract that expires in one month (let's say it gives you the right to buy a certain stock for $50), another option with an expiration date two months later (let's say it gives you the right to buy the same stock for $55), and a third option that expires three months from now (let's say it gives you the right to buy the same stock for $60).

By combining these options, you're creating a "ladder" of sorts, where you have different prices at which you can buy the stock depending on when the options expire.

This can be useful in situations where you're not sure when the best time is to buy the stock. Maybe it's trading at $60 right now, but you're not convinced it's going to stay that high for the next few months. By using an options ladder, you can set yourself up to buy the stock at a lower price if it does drop in the future.

Just like with the blocks, you can arrange the options in different ways to create different ladders. There's no one "right" way to do it, but the idea is to create a combination of options that gives you flexibility and control over when and at what price you can buy the stock.

Now, let's say you want to make a ladder with the blocks. You start with the letter A on the bottom and stack the other blocks on top in alphabetical order. So it goes A, B, C, D, E.

In finance, a ladder is a similar concept but instead of blocks, we're using options (which are like contracts to buy or sell stocks). An options ladder involves buying a combination of options with different expiration dates.

For example, you might buy one option contract that expires in one month (let's say it gives you the right to buy a certain stock for $50), another option with an expiration date two months later (let's say it gives you the right to buy the same stock for $55), and a third option that expires three months from now (let's say it gives you the right to buy the same stock for $60).

By combining these options, you're creating a "ladder" of sorts, where you have different prices at which you can buy the stock depending on when the options expire.

This can be useful in situations where you're not sure when the best time is to buy the stock. Maybe it's trading at $60 right now, but you're not convinced it's going to stay that high for the next few months. By using an options ladder, you can set yourself up to buy the stock at a lower price if it does drop in the future.

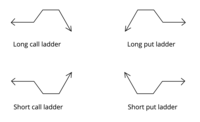

Just like with the blocks, you can arrange the options in different ways to create different ladders. There's no one "right" way to do it, but the idea is to create a combination of options that gives you flexibility and control over when and at what price you can buy the stock.