Low-volatility anomaly

Hello there! Today we're going to talk about something called the low-volatility anomaly. Now, that might sound complicated, but don't worry because I'm going to explain it to you like you're five years old.

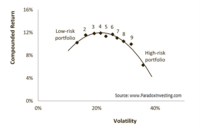

So, the low-volatility anomaly is a funny thing that happens in the stock market. You see, people usually think that when they invest in the stock market, they have to take big risks to get big rewards. If they want to make a lot of money, they have to invest in really fast-growing companies or take chances on companies that are more likely to go up and down a lot.

But here's the thing: sometimes it turns out that the opposite is actually true. Sometimes investments that are less likely to go up and down a lot, that are less "volatile," end up making more money over the long term than the ones that are more risky.

It's a bit like a car race. You might think that the car that goes the fastest will always win, but sometimes the car that just keeps a steady pace ends up being the winner because it doesn't run out of gas or crash into something.

Now, you might be wondering why this happens. Well, economists and other smart people have studied this question a lot, and there are a few ideas. One is that when people get scared or nervous about the stock market, they tend to sell off their riskier investments first. So, if you own a less risky investment, then when the market goes down, you won't lose as much money because other people are selling their riskier stocks instead.

Another idea is that there are some really successful companies out there that just consistently make money year after year, even if they're not growing super fast. These companies are usually in boring, stable industries like utilities or consumer goods. But because they're reliable, investors are willing to pay more for their stocks over the long term.

So, that's the low-volatility anomaly: the fact that investments that are less risky sometimes make more money than the ones that are more risky. It's a bit like the tortoise and the hare: slow and steady can win the race after all!

So, the low-volatility anomaly is a funny thing that happens in the stock market. You see, people usually think that when they invest in the stock market, they have to take big risks to get big rewards. If they want to make a lot of money, they have to invest in really fast-growing companies or take chances on companies that are more likely to go up and down a lot.

But here's the thing: sometimes it turns out that the opposite is actually true. Sometimes investments that are less likely to go up and down a lot, that are less "volatile," end up making more money over the long term than the ones that are more risky.

It's a bit like a car race. You might think that the car that goes the fastest will always win, but sometimes the car that just keeps a steady pace ends up being the winner because it doesn't run out of gas or crash into something.

Now, you might be wondering why this happens. Well, economists and other smart people have studied this question a lot, and there are a few ideas. One is that when people get scared or nervous about the stock market, they tend to sell off their riskier investments first. So, if you own a less risky investment, then when the market goes down, you won't lose as much money because other people are selling their riskier stocks instead.

Another idea is that there are some really successful companies out there that just consistently make money year after year, even if they're not growing super fast. These companies are usually in boring, stable industries like utilities or consumer goods. But because they're reliable, investors are willing to pay more for their stocks over the long term.

So, that's the low-volatility anomaly: the fact that investments that are less risky sometimes make more money than the ones that are more risky. It's a bit like the tortoise and the hare: slow and steady can win the race after all!

Related topics others have asked about: