Minimum corporate tax rate

Imagine you and your friends are playing a game where you earn money by selling lemonade. Sometimes you sell it for a higher price, and other times you sell it for a lower price. However, one day, all of you decide to play the game where you sell lemonade for a fixed price, say $2 per cup. This means that nobody can sell lemonade for less than $2, no matter how tempted they are to make less money.

This is similar to the concept of the minimum corporate tax rate. A "tax rate" is the percentage of money that a corporation has to pay to the government from the money they make. The "minimum" part means that the government sets a limit on how low this tax rate can be. For example, if the minimum corporate tax rate is set at 15%, it means that every corporation must pay at least 15% of their profits to the government, regardless of how much profit they earn.

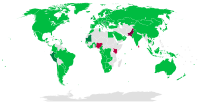

The purpose of setting a minimum corporate tax rate is to ensure that all corporations are contributing their fair share towards the development of the country. It prevents corporations from using loopholes or evading taxes by shifting their profits to countries with lower tax rates. This ensures that the government has enough funds to provide services like education, healthcare, and infrastructure to its citizens.

In summary, a minimum corporate tax rate is a rule set by the government that ensures every corporation pays a minimum percentage of their profits to the government, regardless of how much profit they make. It is similar to a game where all players agree upon a fixed price to sell their goods, so nobody sells their goods below that price.

This is similar to the concept of the minimum corporate tax rate. A "tax rate" is the percentage of money that a corporation has to pay to the government from the money they make. The "minimum" part means that the government sets a limit on how low this tax rate can be. For example, if the minimum corporate tax rate is set at 15%, it means that every corporation must pay at least 15% of their profits to the government, regardless of how much profit they earn.

The purpose of setting a minimum corporate tax rate is to ensure that all corporations are contributing their fair share towards the development of the country. It prevents corporations from using loopholes or evading taxes by shifting their profits to countries with lower tax rates. This ensures that the government has enough funds to provide services like education, healthcare, and infrastructure to its citizens.

In summary, a minimum corporate tax rate is a rule set by the government that ensures every corporation pays a minimum percentage of their profits to the government, regardless of how much profit they make. It is similar to a game where all players agree upon a fixed price to sell their goods, so nobody sells their goods below that price.

Related topics others have asked about: