TED spread

Imagine you have two friends, Ted and Tim. Ted is a little unsure about Tim's reliability when it comes to returning borrowed money. So, Ted asks Tim to pay him extra interest (like giving him a little gift) for borrowing his money. This extra interest makes up for the risk that Ted feels he is taking by lending Tim money.

Now, let's imagine that Ted and Tim are actually big banks that lend and borrow money from each other. In the world of big banks, the Ted Spread is a way of measuring the difference between how much interest they pay on Government loans (which are considered very safe), and how much interest they pay on loans from other banks (which are considered riskier).

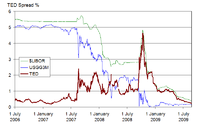

Ted Spread is an important economic indicator because it reflects the level of perceived risk in the financial market. If the Ted Spread is high, it means that banks are paying more to borrow from each other because they are unsure about each other's financial stability. It could also mean that they are expecting some kind of economic crisis or downturn in the near future.

In summary, the Ted Spread is a way of measuring the difference between what banks pay to borrow money from each other compared to how much they pay to borrow from the Government. If that difference is high, it suggests that there is some concern about the financial stability of the banks, and this could indicate a potential economic crisis.

Now, let's imagine that Ted and Tim are actually big banks that lend and borrow money from each other. In the world of big banks, the Ted Spread is a way of measuring the difference between how much interest they pay on Government loans (which are considered very safe), and how much interest they pay on loans from other banks (which are considered riskier).

Ted Spread is an important economic indicator because it reflects the level of perceived risk in the financial market. If the Ted Spread is high, it means that banks are paying more to borrow from each other because they are unsure about each other's financial stability. It could also mean that they are expecting some kind of economic crisis or downturn in the near future.

In summary, the Ted Spread is a way of measuring the difference between what banks pay to borrow money from each other compared to how much they pay to borrow from the Government. If that difference is high, it suggests that there is some concern about the financial stability of the banks, and this could indicate a potential economic crisis.

Related topics others have asked about: