Box spread (options)

Alright kiddo, imagine you have some really cool toys. Now, your friend wants to trade toys with you, but you both want to make sure you get a fair deal. This is where a box spread comes in.

In the world of finance, we have something called options. This is like a toy that you can buy or sell to someone else. Just like with toys, you want to make sure you're getting a fair deal when trading options.

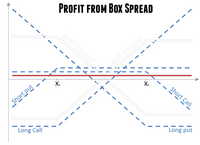

A box spread involves trading four options at the same time to create a box-like structure. The four options consist of two call options and two put options. A call option is like a toy that gives you the right to buy something at a certain price, and a put option is like a toy that gives you the right to sell something at a certain price.

So, imagine you have two call options for a toy car that expire in three months. One option lets you buy the toy car for $10, and the other lets you sell the toy car for $15. You also have two put options for the same toy car that expire in three months. One option lets you sell the toy car for $12, and the other lets you buy the toy car for $17.

To create the box spread, you sell the first call option (to buy at $10) and buy the second call option (to sell at $15). Then, you sell the first put option (to sell at $12) and buy the second put option (to buy at $17). By doing this, you've created a box-like structure where you have a guaranteed profit no matter what happens to the price of the toy car within the next three months.

This is because if the price of the toy car goes up, you have the right to buy it at $10 and sell it at $15, which is a profit of $5. If the price of the toy car goes down, you have the right to sell it at $12 and buy it back at $17, which is also a profit of $5.

In summary, a box spread is a way to trade options in a four-part structure to create a guaranteed profit. It's like trading toys with your friend and making sure you both get a fair deal.

In the world of finance, we have something called options. This is like a toy that you can buy or sell to someone else. Just like with toys, you want to make sure you're getting a fair deal when trading options.

A box spread involves trading four options at the same time to create a box-like structure. The four options consist of two call options and two put options. A call option is like a toy that gives you the right to buy something at a certain price, and a put option is like a toy that gives you the right to sell something at a certain price.

So, imagine you have two call options for a toy car that expire in three months. One option lets you buy the toy car for $10, and the other lets you sell the toy car for $15. You also have two put options for the same toy car that expire in three months. One option lets you sell the toy car for $12, and the other lets you buy the toy car for $17.

To create the box spread, you sell the first call option (to buy at $10) and buy the second call option (to sell at $15). Then, you sell the first put option (to sell at $12) and buy the second put option (to buy at $17). By doing this, you've created a box-like structure where you have a guaranteed profit no matter what happens to the price of the toy car within the next three months.

This is because if the price of the toy car goes up, you have the right to buy it at $10 and sell it at $15, which is a profit of $5. If the price of the toy car goes down, you have the right to sell it at $12 and buy it back at $17, which is also a profit of $5.

In summary, a box spread is a way to trade options in a four-part structure to create a guaranteed profit. It's like trading toys with your friend and making sure you both get a fair deal.

Related topics others have asked about: