Diversification (finance)

Diversification is like wearing lots of different clothes. When you wear one outfit, it might look nice and be just right for the weather. But if it starts raining and you're only wearing one outfit, you won't have any other clothes to change into.

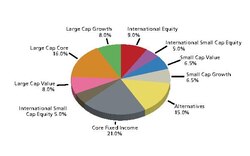

In finance, diversification means spreading your money across different types of investments, like stocks, bonds, mutual funds, and real estate. That way, if one type of investment isn't doing well, you'll still have some of your money in different types of investments that might perform better. It's a way of reducing your risk, since you're not relying on just one type of investment to make money.

In finance, diversification means spreading your money across different types of investments, like stocks, bonds, mutual funds, and real estate. That way, if one type of investment isn't doing well, you'll still have some of your money in different types of investments that might perform better. It's a way of reducing your risk, since you're not relying on just one type of investment to make money.

Related topics others have asked about: