Volatility smile

Imagine you are making a pretty drawing of a smiley face with eyes, nose, and mouth. Now imagine that instead of a regular smile, the mouth is shaped like a roller coaster. This is kind of what a volatility smile looks like.

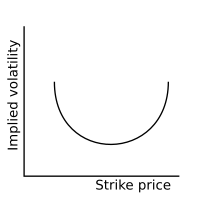

Volatility is a measure of how much a stock or other financial instrument changes in value over time. A volatility smile happens when the volatility of options (which are contracts allowing you to buy or sell a stock at a certain price) changes depending on the strike price of the option.

Basically, when traders look at different strike prices for options on a specific stock, they might notice that the implied volatility (or expected volatility based on the prices of those options) is different for different strikes. In some cases, the volatility might be higher for options that are far out of the money (meaning the strike price is much higher or lower than the stock's current price) than for options that are closer to the money.

This is why it's called a smile - the shape of the volatility curve looks like it's smiling, with higher volatility at extreme strike prices and lower volatility in the middle.

The reason for the volatility smile is somewhat complicated, but it has to do with market expectations and supply and demand. Traders may be willing to pay more for options that allow them to hedge against extreme price movements, which can drive up the implied volatility for out of the money options. On the other hand, options that are closer to the money may be more commonly traded and therefore have more efficient pricing, leading to lower implied volatility.

In the end, the volatility smile is just a way to visualize the complex world of options trading and market dynamics. But if you ever see someone talking about how the volatility smile is affecting their trades, you'll know it's not as scary as it sounds!

Volatility is a measure of how much a stock or other financial instrument changes in value over time. A volatility smile happens when the volatility of options (which are contracts allowing you to buy or sell a stock at a certain price) changes depending on the strike price of the option.

Basically, when traders look at different strike prices for options on a specific stock, they might notice that the implied volatility (or expected volatility based on the prices of those options) is different for different strikes. In some cases, the volatility might be higher for options that are far out of the money (meaning the strike price is much higher or lower than the stock's current price) than for options that are closer to the money.

This is why it's called a smile - the shape of the volatility curve looks like it's smiling, with higher volatility at extreme strike prices and lower volatility in the middle.

The reason for the volatility smile is somewhat complicated, but it has to do with market expectations and supply and demand. Traders may be willing to pay more for options that allow them to hedge against extreme price movements, which can drive up the implied volatility for out of the money options. On the other hand, options that are closer to the money may be more commonly traded and therefore have more efficient pricing, leading to lower implied volatility.

In the end, the volatility smile is just a way to visualize the complex world of options trading and market dynamics. But if you ever see someone talking about how the volatility smile is affecting their trades, you'll know it's not as scary as it sounds!

Related topics others have asked about: